Alaska Property Tax Exemptions . required exemptions can be found in as 29.45.030. These are 1) exemptions that are required by law, and 2) optional. Municipalities are given wide latitude to exempt all or some. on sunday, the senate finance committee proposed tripling the exemption from $150,000 to $450,000. alaska has two kinds of property tax exemptions. alaska seniors age 65 and older can receive a tax exemption on the first $150,000 of the value of their home,. alaska exempts from property taxes the first $150,000 of assessed value for all senior citizens (65 years of age and over) and. in order to have qualified for an exemption, property owners must have summited exemptions by march 15 of the. there are a number of property tax exemptions available in some alaska municipalities. These exemptions lower your assessed value and.

from www.templateroller.com

required exemptions can be found in as 29.45.030. These exemptions lower your assessed value and. on sunday, the senate finance committee proposed tripling the exemption from $150,000 to $450,000. alaska seniors age 65 and older can receive a tax exemption on the first $150,000 of the value of their home,. alaska exempts from property taxes the first $150,000 of assessed value for all senior citizens (65 years of age and over) and. alaska has two kinds of property tax exemptions. there are a number of property tax exemptions available in some alaska municipalities. in order to have qualified for an exemption, property owners must have summited exemptions by march 15 of the. These are 1) exemptions that are required by law, and 2) optional. Municipalities are given wide latitude to exempt all or some.

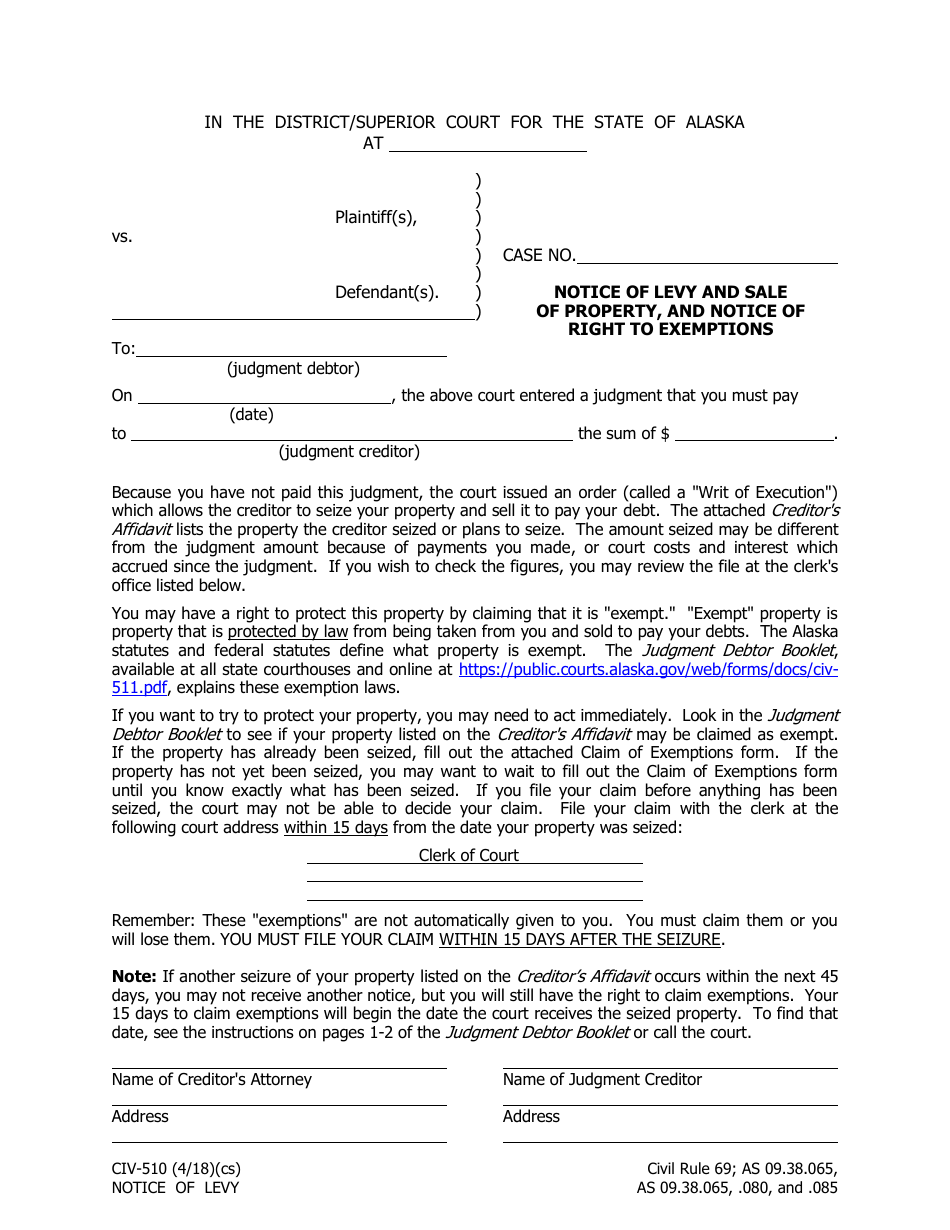

Form CIV510 Fill Out, Sign Online and Download Fillable PDF, Alaska

Alaska Property Tax Exemptions alaska has two kinds of property tax exemptions. in order to have qualified for an exemption, property owners must have summited exemptions by march 15 of the. on sunday, the senate finance committee proposed tripling the exemption from $150,000 to $450,000. These are 1) exemptions that are required by law, and 2) optional. alaska has two kinds of property tax exemptions. there are a number of property tax exemptions available in some alaska municipalities. alaska seniors age 65 and older can receive a tax exemption on the first $150,000 of the value of their home,. These exemptions lower your assessed value and. required exemptions can be found in as 29.45.030. Municipalities are given wide latitude to exempt all or some. alaska exempts from property taxes the first $150,000 of assessed value for all senior citizens (65 years of age and over) and.

From dxovkplfr.blob.core.windows.net

Alaska Property Tax Sale at Sally Westover blog Alaska Property Tax Exemptions there are a number of property tax exemptions available in some alaska municipalities. in order to have qualified for an exemption, property owners must have summited exemptions by march 15 of the. required exemptions can be found in as 29.45.030. alaska seniors age 65 and older can receive a tax exemption on the first $150,000 of. Alaska Property Tax Exemptions.

From exogcclws.blob.core.windows.net

Nome Ak Property Taxes at Antonia Stillwell blog Alaska Property Tax Exemptions there are a number of property tax exemptions available in some alaska municipalities. required exemptions can be found in as 29.45.030. in order to have qualified for an exemption, property owners must have summited exemptions by march 15 of the. These exemptions lower your assessed value and. These are 1) exemptions that are required by law, and. Alaska Property Tax Exemptions.

From templates.legal

Alaska Deed Forms & Templates (Free) [Word, PDF, ODT] Alaska Property Tax Exemptions on sunday, the senate finance committee proposed tripling the exemption from $150,000 to $450,000. required exemptions can be found in as 29.45.030. there are a number of property tax exemptions available in some alaska municipalities. Municipalities are given wide latitude to exempt all or some. alaska exempts from property taxes the first $150,000 of assessed value. Alaska Property Tax Exemptions.

From itep.org

How the House Tax Proposal Would Affect Alaska Residents’ Federal Taxes Alaska Property Tax Exemptions alaska has two kinds of property tax exemptions. there are a number of property tax exemptions available in some alaska municipalities. in order to have qualified for an exemption, property owners must have summited exemptions by march 15 of the. on sunday, the senate finance committee proposed tripling the exemption from $150,000 to $450,000. These are. Alaska Property Tax Exemptions.

From unemployment-gov.us

What is the Alaska Anchorage Property Tax? Unemployment Alaska Property Tax Exemptions alaska exempts from property taxes the first $150,000 of assessed value for all senior citizens (65 years of age and over) and. alaska seniors age 65 and older can receive a tax exemption on the first $150,000 of the value of their home,. These exemptions lower your assessed value and. These are 1) exemptions that are required by. Alaska Property Tax Exemptions.

From www.ballotready.org

County Measure No. 2 Property Tax Exemptions for new or expanding Alaska Property Tax Exemptions in order to have qualified for an exemption, property owners must have summited exemptions by march 15 of the. there are a number of property tax exemptions available in some alaska municipalities. alaska has two kinds of property tax exemptions. alaska exempts from property taxes the first $150,000 of assessed value for all senior citizens (65. Alaska Property Tax Exemptions.

From www.templateroller.com

Alaska State Sales Tax Exemption Response Letter Download Printable Alaska Property Tax Exemptions in order to have qualified for an exemption, property owners must have summited exemptions by march 15 of the. there are a number of property tax exemptions available in some alaska municipalities. required exemptions can be found in as 29.45.030. These exemptions lower your assessed value and. These are 1) exemptions that are required by law, and. Alaska Property Tax Exemptions.

From www.reddit.com

Infographic Who backs Alaska's tax? alaska Alaska Property Tax Exemptions alaska seniors age 65 and older can receive a tax exemption on the first $150,000 of the value of their home,. in order to have qualified for an exemption, property owners must have summited exemptions by march 15 of the. Municipalities are given wide latitude to exempt all or some. These are 1) exemptions that are required by. Alaska Property Tax Exemptions.

From propertywalls.blogspot.com

Do You Have To Pay Property Taxes In Alaska Property Walls Alaska Property Tax Exemptions Municipalities are given wide latitude to exempt all or some. alaska exempts from property taxes the first $150,000 of assessed value for all senior citizens (65 years of age and over) and. alaska seniors age 65 and older can receive a tax exemption on the first $150,000 of the value of their home,. These exemptions lower your assessed. Alaska Property Tax Exemptions.

From www.templateroller.com

Form CIV510 Fill Out, Sign Online and Download Fillable PDF, Alaska Alaska Property Tax Exemptions alaska seniors age 65 and older can receive a tax exemption on the first $150,000 of the value of their home,. alaska exempts from property taxes the first $150,000 of assessed value for all senior citizens (65 years of age and over) and. These exemptions lower your assessed value and. in order to have qualified for an. Alaska Property Tax Exemptions.

From www.pdffiller.com

Fillable Online Alaska Vehicle Rental Tax Government Use Exemption Alaska Property Tax Exemptions alaska seniors age 65 and older can receive a tax exemption on the first $150,000 of the value of their home,. These are 1) exemptions that are required by law, and 2) optional. Municipalities are given wide latitude to exempt all or some. alaska has two kinds of property tax exemptions. on sunday, the senate finance committee. Alaska Property Tax Exemptions.

From www.taxuni.com

Alaska Property Tax Alaska Property Tax Exemptions there are a number of property tax exemptions available in some alaska municipalities. These exemptions lower your assessed value and. required exemptions can be found in as 29.45.030. on sunday, the senate finance committee proposed tripling the exemption from $150,000 to $450,000. Municipalities are given wide latitude to exempt all or some. These are 1) exemptions that. Alaska Property Tax Exemptions.

From infotracer.com

Alaska Property Records Search Owners, Title, Tax and Deeds InfoTracer Alaska Property Tax Exemptions required exemptions can be found in as 29.45.030. in order to have qualified for an exemption, property owners must have summited exemptions by march 15 of the. These are 1) exemptions that are required by law, and 2) optional. alaska has two kinds of property tax exemptions. alaska exempts from property taxes the first $150,000 of. Alaska Property Tax Exemptions.

From dxoilumfl.blob.core.windows.net

How To Apply For Property Tax Exemption In California at Jason Hood blog Alaska Property Tax Exemptions there are a number of property tax exemptions available in some alaska municipalities. required exemptions can be found in as 29.45.030. on sunday, the senate finance committee proposed tripling the exemption from $150,000 to $450,000. alaska exempts from property taxes the first $150,000 of assessed value for all senior citizens (65 years of age and over). Alaska Property Tax Exemptions.

From www.templateroller.com

Alaska Summer Camp Counselor Exemption Fill Out, Sign Online and Alaska Property Tax Exemptions alaska exempts from property taxes the first $150,000 of assessed value for all senior citizens (65 years of age and over) and. on sunday, the senate finance committee proposed tripling the exemption from $150,000 to $450,000. Municipalities are given wide latitude to exempt all or some. required exemptions can be found in as 29.45.030. alaska has. Alaska Property Tax Exemptions.

From joyanswer.org

Understanding Alaska DMV Exemptions Navigating License Regulations Alaska Property Tax Exemptions on sunday, the senate finance committee proposed tripling the exemption from $150,000 to $450,000. alaska has two kinds of property tax exemptions. required exemptions can be found in as 29.45.030. alaska exempts from property taxes the first $150,000 of assessed value for all senior citizens (65 years of age and over) and. Municipalities are given wide. Alaska Property Tax Exemptions.

From www.adn.com

Alaska House votes to levy tax, sending bill to a hostile Senate Alaska Property Tax Exemptions These exemptions lower your assessed value and. alaska seniors age 65 and older can receive a tax exemption on the first $150,000 of the value of their home,. Municipalities are given wide latitude to exempt all or some. alaska has two kinds of property tax exemptions. alaska exempts from property taxes the first $150,000 of assessed value. Alaska Property Tax Exemptions.

From www.kaigi.biz

Cities In Alaska With No Property Tax Alaska Property Tax Exemptions These exemptions lower your assessed value and. required exemptions can be found in as 29.45.030. there are a number of property tax exemptions available in some alaska municipalities. alaska seniors age 65 and older can receive a tax exemption on the first $150,000 of the value of their home,. alaska has two kinds of property tax. Alaska Property Tax Exemptions.